How Hard Money Georgia can Save You Time, Stress, and Money.

Wiki Article

Fascination About Hard Money Georgia

Table of ContentsThe 8-Minute Rule for Hard Money GeorgiaThe Facts About Hard Money Georgia RevealedSome Of Hard Money GeorgiaNot known Details About Hard Money Georgia

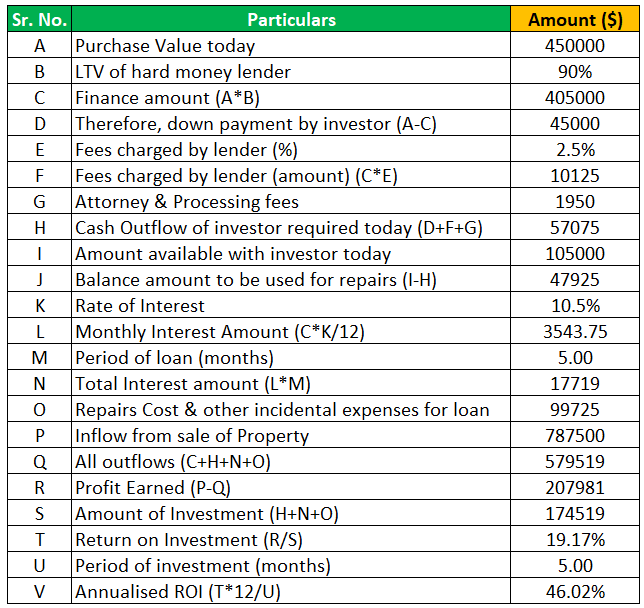

In the majority of areas, rate of interest on difficult money car loans range from 10% to 15%. In enhancement, a consumer may need to pay 3 to 5 points, based on the complete financing quantity, plus any kind of appropriate evaluation, evaluation, and also administrative fees. Numerous hard cash loan providers call for interest-only settlements during the brief duration of the lending.Hard money loan providers make their money from the interest, factors, and also fees billed to the borrower. These lending institutions seek to make a quick turn-around on their investment, thus the higher rate of interest prices as well as shorter regards to hard cash fundings. A difficult cash lending is a good concept if a debtor needs money promptly to invest in a residential property that can be rehabbed and flipped, or rehabbed, rented as well as re-financed in a reasonably brief time period.

They're also great for capitalists that do not have a lot of collateral; the home itself ends up being the security for the car loan. Tough money lendings, however, are not perfect for conventional property owners intending to finance a home long-lasting. They are a helpful tool in the capitalists toolbelt when it pertains to leveraging money to scale their organization - hard money georgia.

For exclusive financiers, the most effective component of obtaining a tough cash lending is that it is simpler than obtaining a standard mortgage from a bank. The authorization procedure is generally a lot less intense. Banks can request a nearly countless collection of papers as well as take several weeks to months to obtain a car loan accepted.

Excitement About Hard Money Georgia

The main function is to see to it the debtor has a leave technique and isn't in economic wreck. Yet many tough cash lending institutions will certainly deal with individuals who don't have fantastic debt, as this isn't their largest problem. The most essential point difficult money lenders will take a look at is the investment building itself.

They will certainly also assess the debtor's scope of work as well as spending plan to guarantee it's reasonable. Often, they will certainly quit the procedure due to the fact that they either believe the building is too far gone or the rehabilitation budget plan is impractical. Lastly, they will examine the BPO or assessment as well as the sales and/or rental comps to guarantee they concur with the examination.

Yet there is one more advantage developed right into this process: You get a 2nd collection of eyes on your deal as well as one that is materially purchased the task's result at that! If an offer is poor, you can be fairly useful source positive that a hard cash lending institution will not touch it. Nonetheless, you ought to never use that as a justification to discard your very own due diligence.

The very best location to try to find hard cash lending institutions is in the Bigger, Pockets Hard Money Lender Directory Site or your neighborhood Realty Investors Association. Remember, if they've done right by another investor, they are likely to do right by you.

More About Hard Money Georgia

Check out on as we go over hard money loans and also why they are such an eye-catching choice for fix-and-flip genuine estate capitalists. One major benefit of hard cash for a fix-and-flip capitalist is leveraging a trusted lending institution's reputable resources as well as rate.You can take on projects incrementally with these critical lendings that allow you to rehab with simply 10 - 30% down (depending upon the lending institution). Difficult cash fundings are typically short-term car loans used by investor to fund repair and also flip residential properties or various other realty financial investment deals. The residential or commercial property itself is used as collateral for the lending, as well as the top quality of the property offer is, therefore, much more crucial than the borrower's link credit reliability when receiving the funding.

Nevertheless, this likewise means that the threat is greater on these financings, so the rate of interest are usually higher also. Deal with and also flip investors choose difficult cash since the marketplace doesn't wait. When the opportunity occurs, and also you prepare to obtain your job right into the rehabilitation stage, a hard money lending obtains you the money straightaway, pending a fair assessment of the organization deal. hard money georgia.

Ultimately, your terms will depend on the hard money loan provider you pick to work with as well as your one-of-a-kind scenarios. Here's a listing of typical requirements or certifications. Geographical area. Most difficult cash loan providers operate in your area or only in particular regions. Many run across the country, Kiavi presently lends in 32 states + DC (and counting!).

Our Hard Money Georgia Diaries

Intent as well as property documentation includes your in-depth range of read this article job (SOW) and also insurance policy. To evaluate the property, your loan provider will consider the value of equivalent residential or commercial properties in the location and also their estimates for development. Following an estimate of the home's ARV, they will certainly money an agreed-upon percent of that worth - hard money georgia.This is where your Scope of Work (SOW) enters play. Your SOW is a document that information the work you mean to perform at the residential or commercial property as well as is typically required by many difficult money lenders. It consists of renovation expenses, duties of the parties involved, as well as, frequently, a timeline of the deliverables.

Let's assume that your property doesn't have a completed cellar, yet you are intending to finish it per your range of work. Your ARV will be based upon the sold rates of comparable houses with ended up basements. Those costs are likely to be greater than those of residences without finished basements, therefore increasing your ARV and also possibly qualifying you for a higher finance quantity.

Report this wiki page